Rockland County Real Property Records

Search Rockland County Public Property Records Online CourthouseDirect.com

These cookies enable the website to provide enhanced functionality and personalisation. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies then some or all of these services may not function properly.

https://www.courthousedirect.com/PropertySearch/NewYork/Rockland

Rockland County, NY

Land/Court Records Search · Passport Information and Application · Job ... Jan 2026. >> Calendar Grid 330405. S, M, T, W, T, F, S. 28 · 29 · 30 · 31 · 1 · 2 · 3.

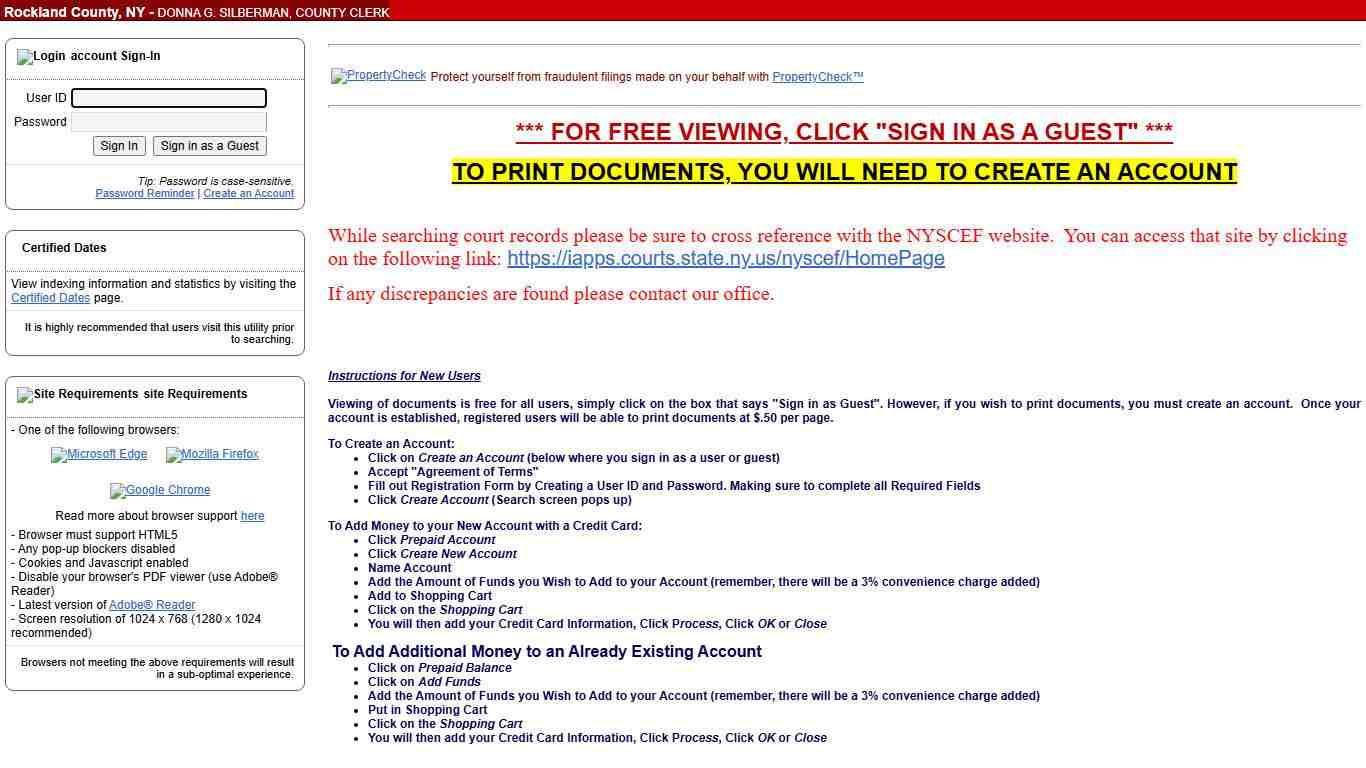

https://www.rocklandcountyny.gov/eSearch Account Sign In

*** FOR FREE VIEWING, CLICK "SIGN IN AS A GUEST" *** TO PRINT DOCUMENTS, YOU WILL NEED TO CREATE AN ACCOUNT While searching court records please be sure to cross reference with the NYSCEF website. You can access that site by clicking on the following link: https://iapps.courts.state.ny.us/nyscef/HomePage If any discrepancies are found please contact our office.

https://cotthosting.com/NYRocklandExternal

Rockland County, NY property records & home values

2026 housing market predictionsNEW; 2025 hottest zip codes. Guides & more. All guides · Complete guide on how to sell your home · First-time home buyer resource ...

https://www.realtor.com/propertyrecord-search/Rockland-County_NYNETR Online • Rockland • Rockland Public Records, Search Rockland Records, Rockland Property Tax, New York Property Search, New York Assessor

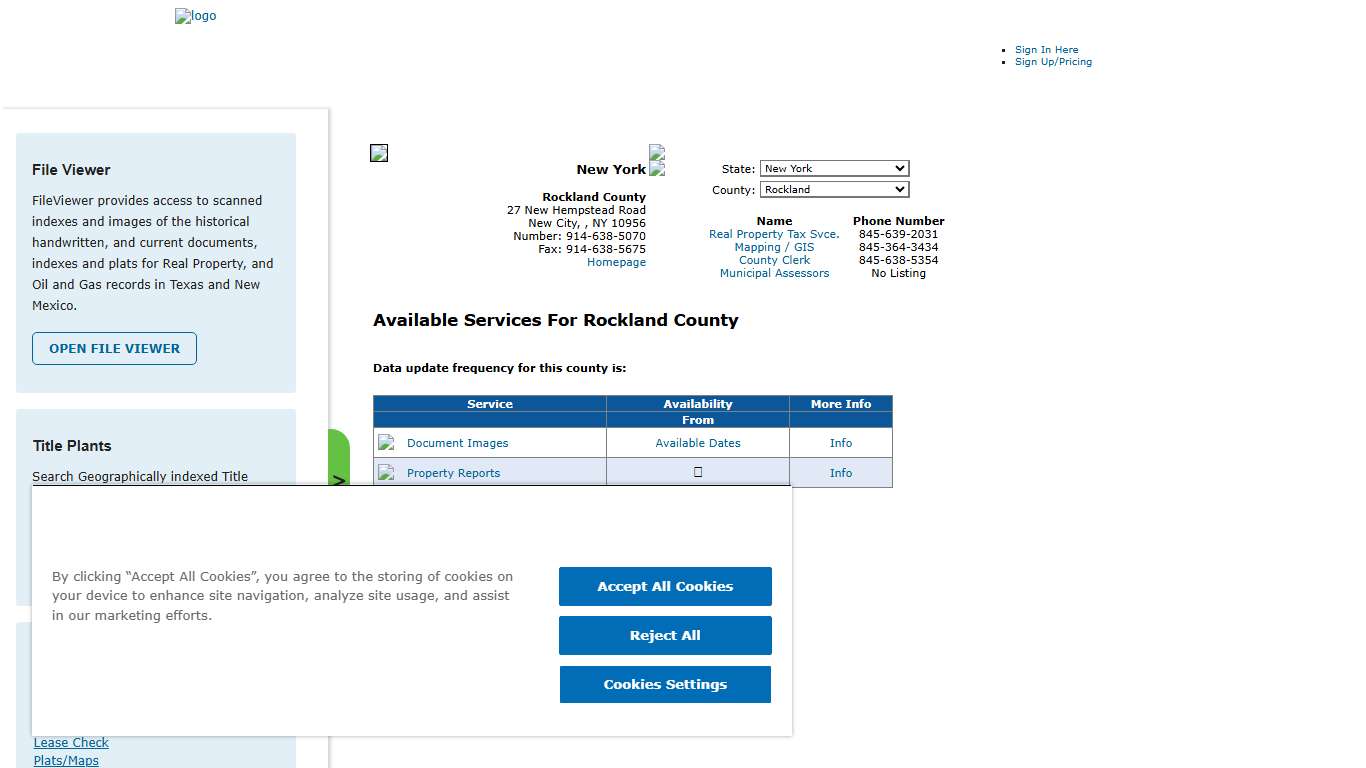

Select: Rockland County Public Records The Empire State Rockland County Clerk (845) 638-5069 Rockland Real Property Tax Service (845) 638-5070 Rockland Municipality Taxing Districts Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store Comparable Properties Reports...

https://publicrecords.netronline.com/state/NY/county/rockland

Welcome

The information in this database is for Fiscal Year 2026. The Assessments are as of January 1, 2025. The Tax Rate for Fiscal Year 2026 is $13.87.

http://www.assessedvalues2.com/index.aspx?jurcode=251NY Property Tax Search PropertyShark

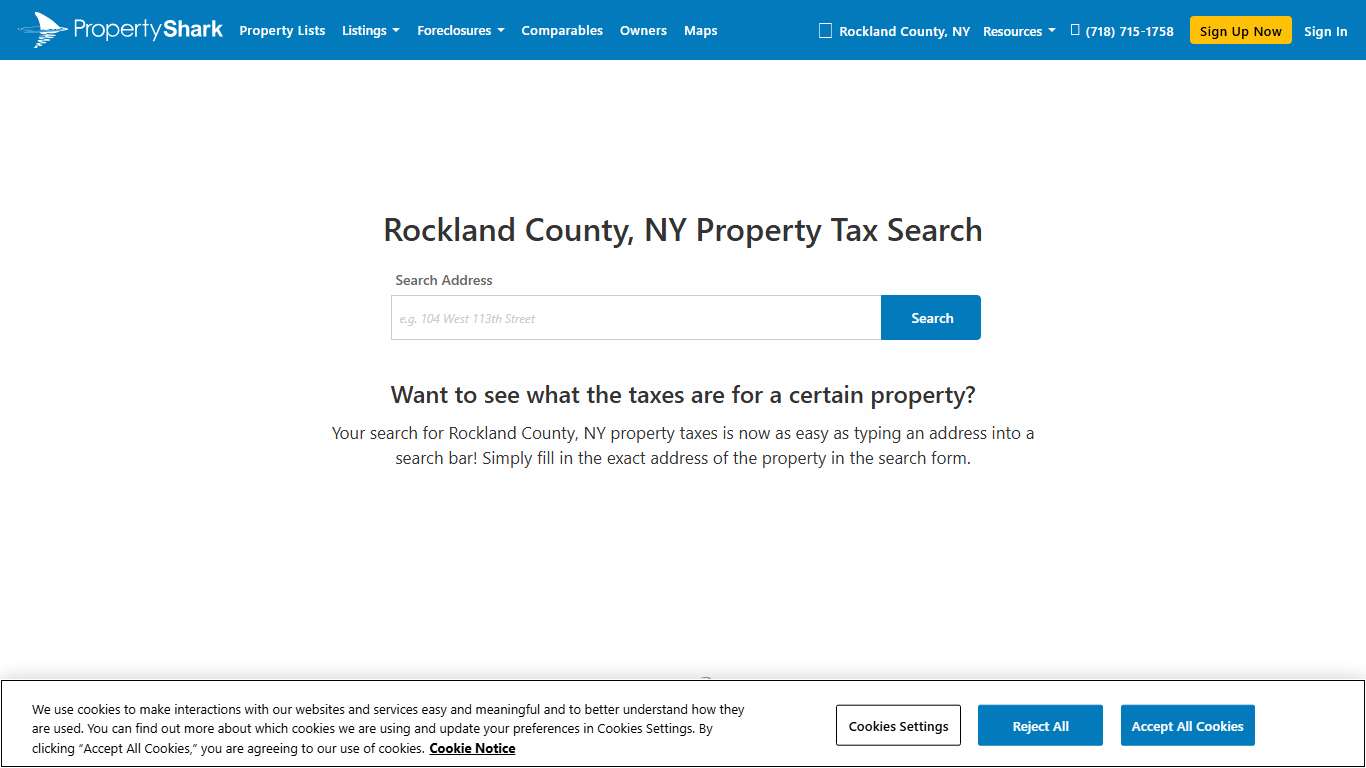

Rockland County, NY Property Tax Search Want to see what the taxes are for a certain property? Your search for Rockland County, NY property taxes is now as easy as typing an address into a search bar! Simply fill in the exact address of the property in the search form.

https://www.propertyshark.com/mason/info/Property-Taxes/NY/Rockland-County/

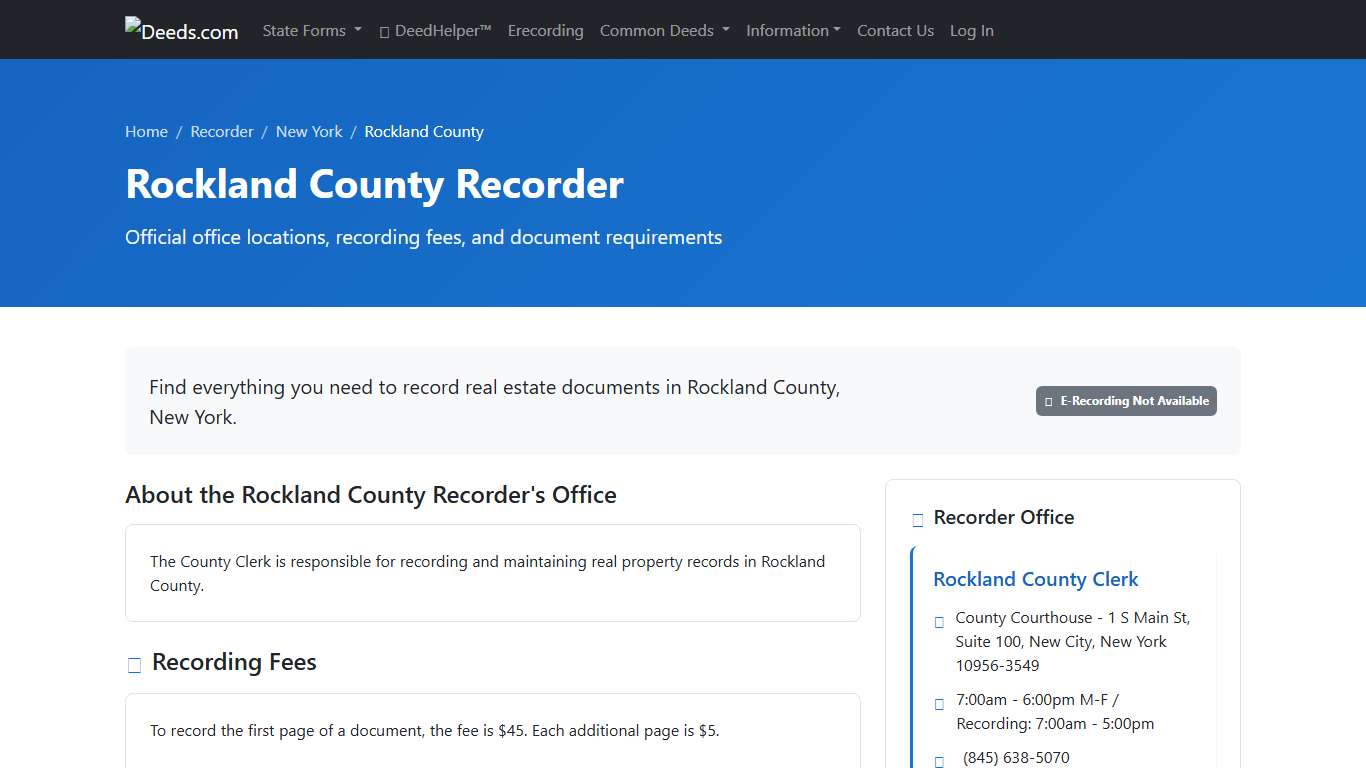

Rockland County Recorder Information, New York - Deeds.com

Find everything you need to record real estate documents in Rockland County, New York. Rockland County Clerk County Courthouse - 1 S Main St, Suite 100, New City, New York 10956-3549 7:00am - 6:00pm M-F / Recording: 7:00am - 5:00pm (845) 638-5070 About the Rockland County Recorder's Office The County Clerk is responsible for recording and maintaining real property records in Rockland County.

https://www.deeds.com/recorder/new-york/rockland/

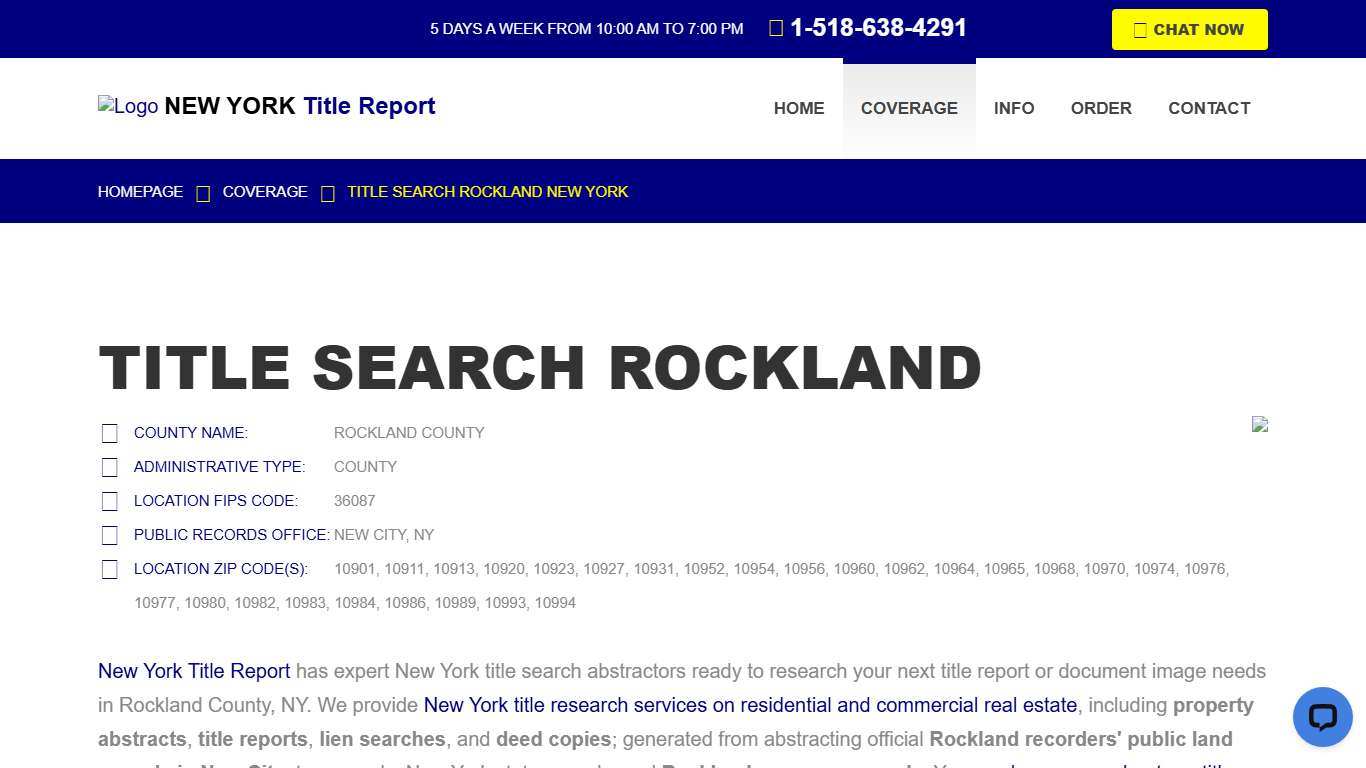

Title Search Rockland, NY - Property Records Research & Reports

- County Name: Rockland County - Administrative Type: County - Location FIPS Code: 36087 - Public Records Office: New City, NY - Location Zip Code(s): 10901, 10911, 10913, 10920, 10923, 10927, 10931, 10952, 10954, 10956, 10960, 10962, 10964, 10965, 10968, 10970, 10974, 10976, 10977, 10980, 10982, 10983, 10984, 10986, 10989, 10993, 10994 New York Title Report has expert New York title search abstractors ready to research your next title report...

https://newyorktitlesearch.com/new-york-counties-serviced/lien-title-search-property-records-rockland-county

Board of Assessors Rockland Town, MA

Learn about the role of the Board of Assessors.

https://rockland-ma.gov/359/Board-of-Assessors

Town Clerk/Tax Collector Town of Rockland, New York

Office of Town Clerk Marinella Di Vita Town Clerk / Tax Collector / Registrar / Notary Public Email: [email protected] OR [email protected] Mary Hankins / Deputy Town Clerk Deborah Feinberg / Deputy Town Clerk Mailing address PO Box 964 Livingston Manor, NY 12758 Phone: 845-439-5450 Ext.

https://www.townofrocklandny.com/town-clerk/

Property Tax

Non-homestead mobile home owners must file a return for their mobile home's taxes, pay all taxes due, and purchase a location permit decal between January 1 and May 1 of each year. Failure to display a location decal can result in a court citation.

https://rockdaletaxoffice.org/property-tax

Zero Increase in County... - Rockland County Government Facebook

Through disciplined budgeting, tough decisions, and smart planning, we transformed our fiscal health from worst to first. #RocklandCounty now stands as the only county in New York State with Moody’s highest possible Triple-A bond rating. That is an incredible accomplishment, and it means we are recognized nationally as one of the fiscally strongest counties in the state.

https://www.facebook.com/rocklandgov/posts/zero-increase-in-county-property-taxes-proposed-for-2026-budgetthrough-disciplin/1421258786235828/

Town and County Tax Information Town of Orangetown

The Receiver of Taxes collects the Town & County Property Taxes in January. The bills are mailed in early January. The tax bill covers the period of January 1st – December 31st. Payments can be made upon receipt of bill through January 31st, there is a 1% penalty thru February 28th.

https://www.orangetown.com/town-and-county-tax-information/

NY000552 - Rockland County – Electronic RP-5217 Virtual Underwriter

Bulletin: NY000552 Beginning January 2015, the Rockland County Clerk will require that all documents submitted for recording requiring a Real Property Transfer Report use the bar-coded Form RP-5217-PDF. The carbonized form will not be accepted. Using an electronic SaleScan system, the Clerk will electronically trans...

https://www.virtualunderwriter.com/bulletins/2014/10/ny000552

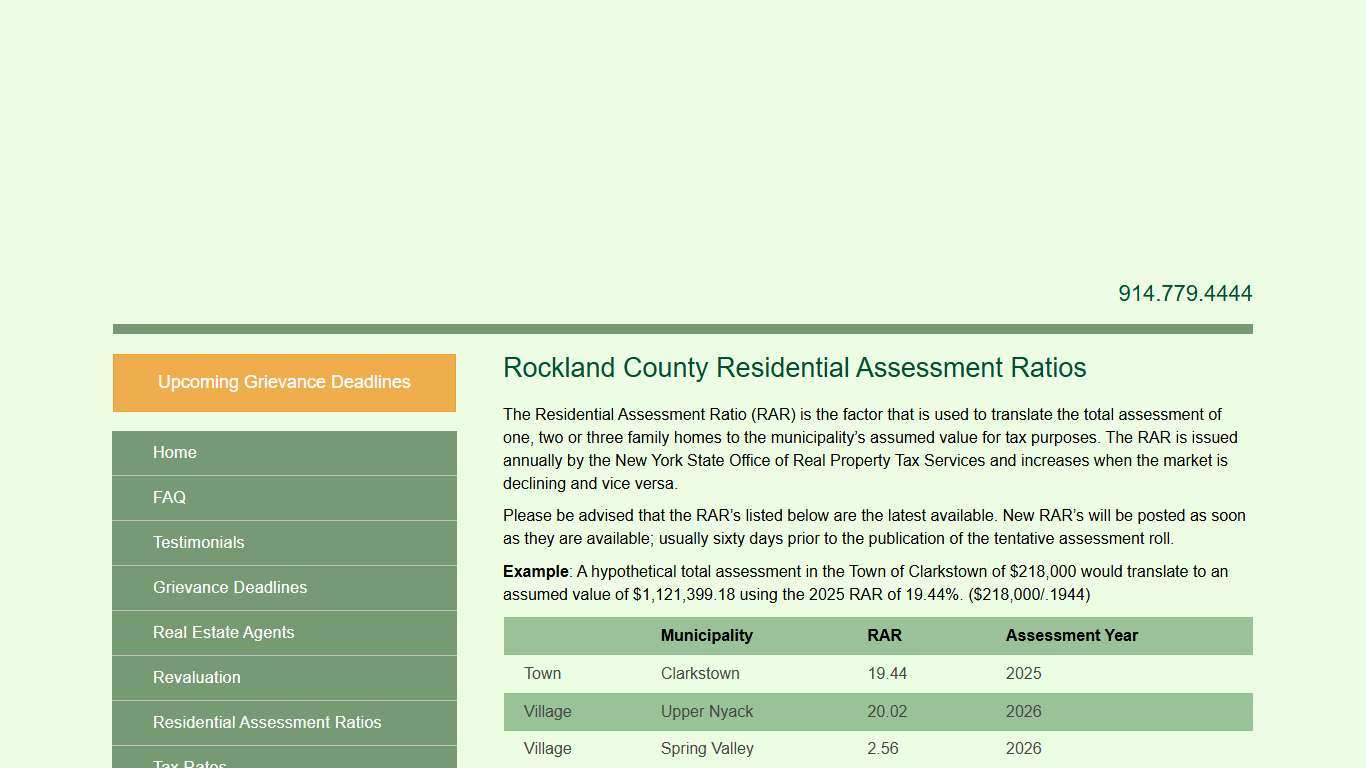

Rockland County Residential Assessment Ratios - O'Donnell & Cullen Property Tax Consultants

The Residential Assessment Ratio (RAR) is the factor that is used to translate the total assessment of one, two or three family homes to the municipality’s assumed value for tax purposes. The RAR is issued annually by the New York State Office of Real Property Tax Services and increases when the market is declining and vice versa.

https://retiredassessor.com/residential-assessment-ratios/rockland-county-residential-assessment-ratios/